How Social Listening Turns Conversations into Business Gold

You know how some South African brands seem to nail it every time? They jump on a trending conversation in minutes, respond with wit, and leave the internet talking. Think Nando’s, Checkers, or any brand that makes you wonder, how did they do that so quickly?

It is not magic. It is the power of social listening, backed by smart technology and expertise.

Platforms like Brandwatch help turn the endless noise of social media into actionable insight. Here is a peek behind the curtain.

Step One: Collecting the Data

Social listening starts with access to the right information. We are not scrolling timelines all day. Instead, platforms such as Brandwatch have official agreements and direct API partnerships with major social networks.

This means legitimate, compliant, and comprehensive access to data from X, Facebook, Instagram, YouTube, Reddit, LinkedIn, and TikTok. Publicly available conversations flow into a secure hub, creating a live, always-on feed of what your market is talking about.

For brands in South Africa, this provides a real-time view into the heartbeat of your audience.

Step Two: Making Sense of the Noise

Raw data on its own is messy and overwhelming. That is where artificial intelligence (AI) and natural language processing (NLP) step in.

Brandwatch analyses millions of posts to understand sentiment: is it positive, negative, or neutral? It can pick up on sarcasm, regional slang, and local nuances, which is vital in a market as culturally diverse as South Africa.

It then organises conversations by theme, highlights emerging trends, and identifies the people, products, or moments that matter most. Instead of a wall of unstructured chatter, you get clear, meaningful information you can actually use.

👉 Related: 5 Ways Social Monitoring Helps Banks Spot Fraud Signals Fast

Step Three: Turning Insight into Action

Once you have structured insights, the real impact begins. Insights shape strategy and help brands engage the right audience at the right time.

One example comes from a sports-related campaign. By analysing social conversations, it was clear that football dominates the South African sports conversation. This finding informed a campaign targeting specific fan communities with content that spoke directly to their passion. The result was exceptional engagement and measurable sales growth. That is the magic of insight-driven marketing. It connects brand action to customer passion.

Why Social Listening is Essential

Social listening is more than just monitoring mentions. It is a way to:

- Anticipate trends before they peak.

- Understand customer sentiment in real time.

- Tailor content and campaigns to cultural context.

- React faster and smarter to public conversations.

👉 Read next: Spotting Trends Before They Break: Gain the Edge With Social Insight

Ready to See How It Works for Your Business?

Social listening can transform how your brand connects with customers and the market.

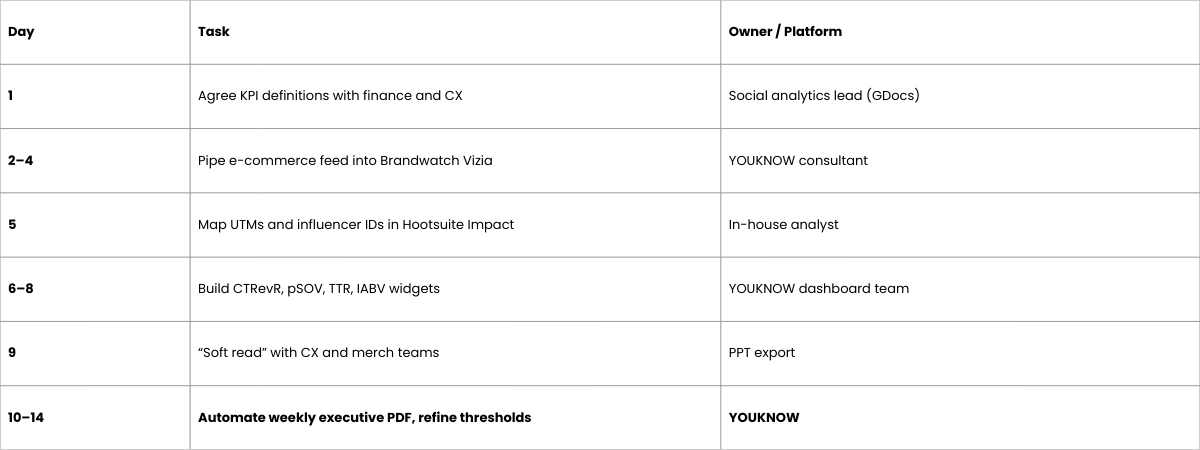

Take our Easy Peasy Social Health Check to benchmark your listening strategy, or book a Brandwatch Demo with YOUKNOW to see it in action.

When you are ready to scale, explore our Solutions Page to see how YOUKNOW can implement, support, and optimise Brandwatch for your business.

.avif)

.png)

.png)

.jpg)

.svg)